Corporate tax revenues fell by 92 billion 31 due primarily to the Tax Act from 15 GDP in 2017 to 10 GDP in 2018 half the 50-year average of 20 GDP. 19c for each 1 over 18200.

Resident tax rates for 201819.

. Individual income tax receipts rose by 96 billion as the economy grew rising from 82 GDP in 2017 to 83 GDP in 2018. The amount of income tax and the tax rate you pay depends on how much you earn. Your 2021 Tax Bracket To See Whats Been Adjusted.

For tax years beginning before January 1 2022 New York State personal income tax is decoupled from any changes made to the IRC after March 1 2020. Form MO-1040 Individual Income Tax Long Form Author. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Tax Rate Chart Tax Calculation Worksheet. The more you earn the higher your rate of tax.

Single or Married filing sepa-rately12000. Individual income tax rates for prior years. Estimated Income Tax Payment Voucher for Fiduciaries - Payments due April 17 June 15 September 17 2018 and January 15 2019.

The chargeable income of non-resident individuals is generally taxed at a flat rate of 20. Commissioner for Revenue Inland Revenue Personal Tax Tax Rates 2018. Income Tax Rates and Thresholds Annual Tax Rate.

Important information for NYC residents with taxable income over 500000. Ad No Need To Wait. Easily And Quickly File Your Prior Year Tax Returns With TurboTax Today.

Therefore If you file an amended 2018 federal return due solely to changes made to the Internal Revenue Code IRC after March 1 2020 do not file an amended 2018 New York State tax return. You may qualify if you earned less than 49194 54884 if married filing jointly and have qualifying children or you have no qualifying children and you earned less than 15270 20950 if married filing jointly. IT-2106 Fill-in IT-2106-I Instructions Fiduciaries.

5092 plus 325 cents for each 1 over 45000. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Missouri Department of Revenue Created.

Discover Helpful Information And Resources On Taxes From AARP. Underpayment of Estimated Income Tax By Individuals and Fiduciaries for tax year 2018. Tax Rates for Basis.

The above rates do not include the Medicare levy of 2. Standard deduction amount in-creased. 29467 plus 37 cents for each 1 over 120000.

Individual income taxes are a major source of state. Yourself Spouse Example A Example B 1Missouri taxable income Form MO-1040. Income from employment An individuals income from employment for a calendar year is the gains and profits of that individual from the employment for that year or a part of the year.

United Kingdom Non-Residents Income Tax Tables in 2018. Married filing jointly or Qualify-. Your taxable income is now 39000 which puts you in the 22 tax bracket for your filing status.

For 2018 most tax rates have been reduced. To calculate your North Carolina tax liability multiply your North Carolina taxable income by 5499 005499. To identify your tax use your Missouri taxable income from Form MO-1040 Line 23Y and 23S and the tax chart in.

For tax years 2017 and 2018 the individual income tax rate is 5499. Tax on this income. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 and 2.

Federal Earned Income Tax Credit EIC EIC reduces your federal tax obligation or allows a refund if no federal tax is due. Change in tax rates. Ad Download or Email 1099-INT More Fillable Forms Register and Subscribe Now.

The 2018 tax rates are 10 12 22 24 32 35 and 37. 51667 plus 45 cents for each 1 over 180000. Now you need to calculate your tax using the 10 rate on your income up to 9525 the 12 rate on income between 9526 and 38700 and 22 on the portion of your income in excess of 38700.

Ad Compare Your 2022 Tax Bracket vs. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500000 and higher for single filers and 600000 and higher for married couples filing jointly. For 2018 the standard deduction amount has been in-creased for all filers.

19 cents for each 1 over 18200.

Effective Tax Rate Formula Calculator Excel Template

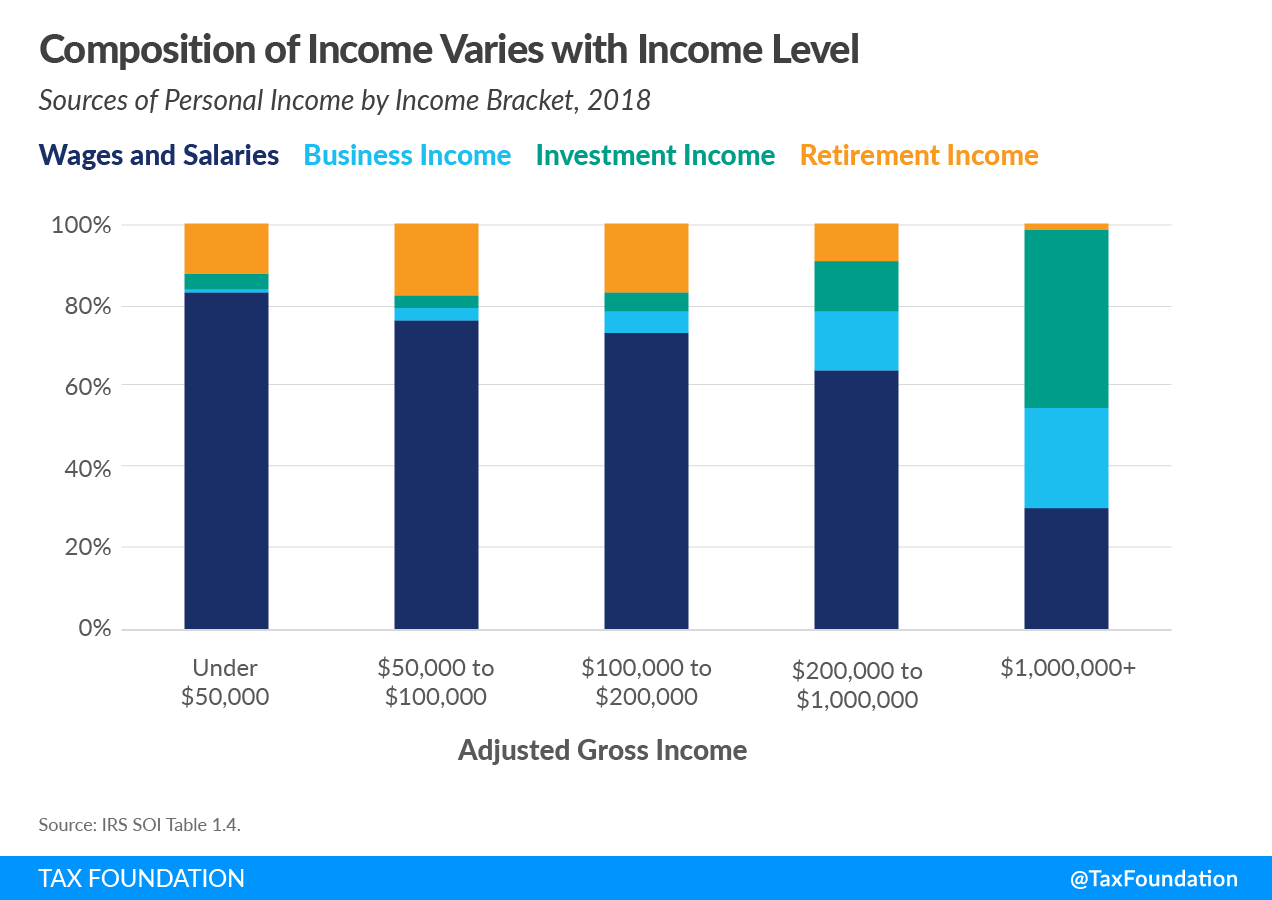

Sources Of Personal Income In The United States Tax Foundation

Taxtips Ca Business 2020 Corporate Income Tax Rates

How The Tcja Tax Law Affects Your Personal Finances

Who Pays U S Income Tax And How Much Pew Research Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

How Much Does A Small Business Pay In Taxes

Income Tax Malaysia 2018 Mypf My

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Rates For Year Of Assessment 2018 T Plctaxconsultants

Who Pays U S Income Tax And How Much Pew Research Center

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories